A Watershed Moment for the PEO Industry

Congress Passes Small Business Efficiency Act

The U.S. Senate passed the Small Business Efficiency Act (SBEA), NAPEO’s top federal legislative priority, on December 16, 2014. The House of Representatives previously approved it as an amendment to the Achieving a Better Life Experience (ABLE) Act to offset the costs associated with that proposal, then incorporated it into the tax extenders legislation. President Obama signed the tax extenders legislation, which included the SBEA, on Friday, December 19. The SBEA defines PEOs in the federal tax code and creates a voluntary certification program for PEOs within the IRS.

It only took 17 years to enact the Small Business Efficiency Act.

17 years.

When the process began, Bill Clinton was president, Newt Gingrich was speaker of the House, and Trent Lott was the Senate majority leader. Through three administrations, four speakers, three Senate majority leaders, varying partisan majorities, different bill sponsors, and changing NAPEO membership and personnel, the PEO industry lobbied, pushed, cajoled, and at times pestered Congress to act on the SBEA. There were close calls, like in 2007 when the Senate twice passed legislation containing the SBEA, only to have it removed by the House. And, there were times when it seemed that Congress would never act.

By 2013, the groundwork for the SBEA had been completed. The professional staff of the House Ways and Means Committee had reviewed it, the Joint Committee on Taxation had “scored” it, and it had been included in a discussion draft of tax reform legislation. The bill was identical in the House and Senate, key tax committee and leadership staffs had been educated about it, and our bill champions were ready to go. The challenge—in a Congress that was hopelessly gridlocked—was to find a piece of tax legislation to attach the SBEA to that would actually pass the House and Senate and be signed by the president.

NAPEO staff advised members of the Federal Government Affairs Committee and the NAPEO Board of Directors that when the stars aligned and a legislative vehicle emerged for the SBEA, we would find out after the fact.

And then it happened—just as predicted.

On December 3, the House Rules Committee announced it was holding a hearing on the ABLE Act to bring it to a vote in the full House of Representatives. The ABLE Act creates tax-exempt savings accounts for disabled individuals and their families. The SBEA was included as a “pay-for” in the ABLE Act, to offset the costs of the savings accounts. Our House bill sponsor, Rep. Kevin Brady (R-TX), along with House Ways and Means Committee Chair Dave Camp (R-MI), had added the SBEA to the ABLE Act.

The right legislative vehicle had come along—a bill with broad bipartisan support that would be signed by the president. It took almost three more weeks, but on December 19, the president signed the tax extenders bill—which contained the ABLE Act and the SBEA. The SBEA became Public Law 113-295.

Now that the SBEA has become public law, what does it mean for the PEO industry? How will it work? And, what will your PEO have to do to comply with it? This special report will answer the basic questions about the SBEA and the process of implementing the law.

What Does the Small Business Efficiency Act Mean for the PEO Industry?

Thom Stohler

Now that the Small Business Efficiency Act (SBEA) is the law of the land, what changes should the PEO industry be considering in order to come into compliance with its provisions? Before you start changing your company’s business practices, it is important to understand what the SBEA requires, the limitations of its applicability, and the timeline for its implementation.

SBEA is a Voluntary Program

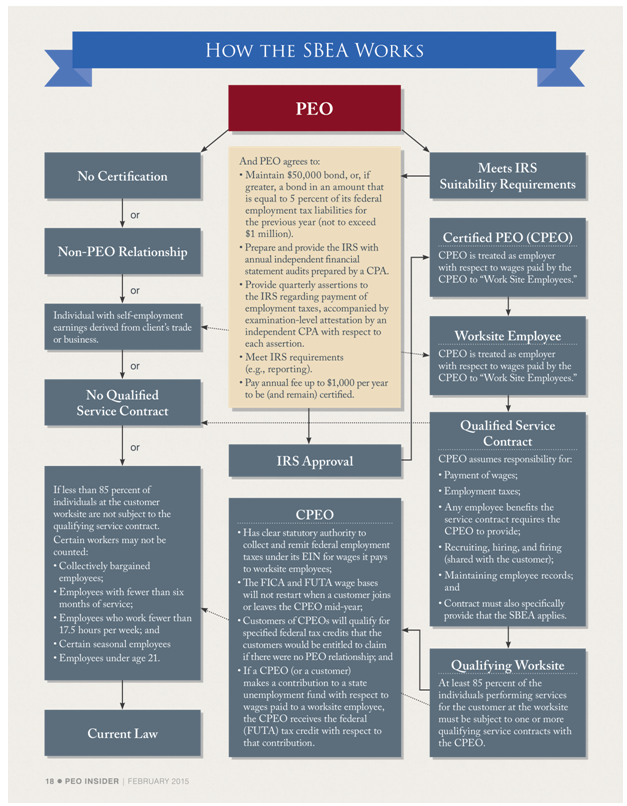

First and foremost, it is important to understand that the SBEA requires the Internal Revenue Service (IRS) to create a voluntary certification program for PEOs. There is no requirement that you certify your PEO with the IRS. If you choose not to certify your PEO, the law in effect before the SBEA will continue to apply. It is equally important to note that even if you are certified, the SBEA will never apply to your ASO or other non-PEO arrangements.

PEO Certification

The SBEA sets the requirements for PEOs to become certified by the IRS. The requirements are:

- Bonding—An IRS-certified PEO (CPEO) must maintain the greater of a $50,000 bond or a bond in an amount that is equal to 5 percent of the CPEO’s federal employment tax liabilities for the previous year (however, the required bond is not to exceed $1 million);

- Annual Audits—A CPEO must prepare and provide the IRS with annual independent financial statement audits prepared by a CPA;

- Quarterly CPA Attestations on Employment Taxes—A CPEO must provide quarterly assertions to the IRS regarding payment of all employment taxes, accompanied by an examination-level attestation by an independent CPA with respect to each such assertion;

- Reporting and Other IRS Requirements—A CPEO must meet various other IRS requirements (including use of accrual accounting, special reporting rules, and background checks); and

- Annual Fee—The CPEO must pay an annual fee of up to $1,000 per year to be (and remain) certified.

Application of the SBEA for CPEOs

Even for those PEOs that choose to become IRS certified, the SBEA will not necessarily apply to all of the CPEO’s clients or all of the CPEO’s worksite employees. There are specific limitations on the circumstances under which the CPEO’s customers* and CPEO co-employees performing services for those customers will be able to gain the benefits of the SBEA.

* Important Note: The SBEA refers throughout to our clients as “customers.” It is a term that will probably become increasingly prevalent in the industry because of the SBEA.

Similar to the term “customer,” there are several other key terms in SBEA. These are “work site employee,” “qualifying service contract,” and “qualifying work site.” These are critical to understanding the SBEA.

Worksite Employees

Once the IRS certifies a PEO, the SBEA treats the CPEO as the employer with respect to wages paid to “work site employees” for certain employment-related taxes and the customer as the employer for certain tax credits. The SBEA defines a “work site employee” as an individual who performs services for a PEO customer under a “qualifying service contract” at a “qualifying work site.” However, an individual with self-employment earnings derived from the client’s trade or business cannot be a worksite employee with respect to remuneration paid by the CPEO.

Qualifying Service Contract

A CPEO is treated as the employer with respect to wages paid by the CPEO to worksite employees who perform services under a “qualified service contract.” A qualified service contract between a CPEO and a customer is one in which the CPEO assumes responsibility for:

- Payment of wages to employees, without regard to the receipt or adequacy of payment from the customer for such services;

- Reporting, withholding, and paying any applicable taxes with respect to such employees’ wages, without regard to the receipt or adequacy of payment from the customer for such services;

- Any employee benefits the service contract requires the CPEO to provide, without regard to the receipt or adequacy of payment from the customer for such benefits; and

- Recruiting, hiring, and firing workers (in addition to the customer’s responsibility for recruiting, hiring, and firing workers).

In addition to these responsibilities, a CPEO would have to maintain employee records relating to worksite employees, and the contract between the CPEO and the customer would have to specify to the customer that the provisions of the SBEA apply to its contract.

Qualified Worksite

In addition to being covered by a qualified service contract, a worksite employee would have to work at a qualified worksite. A qualified worksite is defined as a worksite where at least 85 percent of the individuals performing services for the customer are subject to one or more qualifying service contracts with the CPEO. Certain individuals are not required to be counted when determining whether 85 percent of the individuals at a worksite are performing services for the customer, including:

- Collectively bargained employees;

- Employees with fewer than six months of service;

- Employees who work fewer than 17.5 hours per week;

- Certain seasonal employees; and,

- Employees under age 21.

SBEA Provisions

If the IRS certifies your PEO, and if the worksite employees of your customer (client) are covered by a qualified service contract at a qualified worksite, the provisions of the SBEA apply. Once the conditions of the SBEA are met, a CPEO would:

- Be treated as the employer of the worksite employees for purposes of collection and remission of federal employment taxes. (This provides clear statutory authority to collect and remit federal employment taxes under the CPEO’s EIN for wages the CPEO pays to worksite employees);

- Assume sole liability for the collection and remission of the federal employment taxes with respect to wages paid by the CPEO to worksite employees;

- Not have to restart the FICA and FUTA wage bases when a customer joins or leaves a CPEO mid-year; and

- Be responsible for the payment of wages to the worksite employees, for keeping records on the worksite employees, and for reporting information on the worksite employees to the IRS.

CPEO customers also can benefit from the SBEA. The provisions of the SBEA clarify that customers of CPEOs are eligible for specified federal tax credits they would be entitled to claim if there were no PEO relationship. More importantly, during the course of the contract, the customers of a CPEO can be assured that the PEO becomes solely liable for their federal payroll taxes. There is no potential joint and several or secondary liability for the customer.

Timeline for Implementation

The SBEA also sets out requirements for the IRS. The IRS is directed to establish a PEO certification program by the end of June 2015. The IRS is required to publish a list of CPEOs as well as a list of those CPEOs who have had their certification revoked or suspended. In addition, the government will have to provide necessary reporting and recordkeeping rules and procedures, including rules that require the CPEO to track and report the “commencement or termination” of a service agreement with a customer.

The effective date of the SBEA is January 1, 2016, which doesn’t leave much time for the IRS to do its job. So, even though the SBEA is now the law, our work is not finished. Many of the details of implementation have been left to the IRS, which will have to provide guidance through a rulemaking process. NAPEO has retained Randy Hardock of Davis & Harman to help ensure that the government will establish workable rules consistent with the purposes of the SBEA. NAPEO has created a small but diverse working group chaired by Greg Packer, CEO of AccessPoint and 2015 NAPEO Federal Government Affairs Committee chairman, to help provide PEO industry expertise to Randy and the IRS during the rulemaking process.

NAPEO members with questions or comments should send them to me at tstohler@napeo.org for the working group’s consideration. Bringing NAPEO resources to the IRS will help ensure the final regulations result in a streamlined, transparent, and efficient certification process for PEOs.

Thom Stohler is vice president of federal government affairs for NAPEO, Alexandria, Virginia.

A 17-Year Legislative Effort, and a Big ‘Thank You’ to those in Congress Who made it Happen

Getting a bill through Congress and signed by the president is an enormous undertaking. The SBEA is no exception. The PEO industry was fortunate to have four Members of Congress dedicated to passing the SBEA: Rep. Kevin Brady (R-TX), Sen. Charles Grassley (R-IA), Sen. Bill Nelson (D-FL), and Rep. Mike Thompson (D-CA). Their efforts made passage of the SBEA possible.

Over the past several years, Rep. Brady has quietly worked with his colleagues on the House Ways and Means Committee to promote the SBEA and look for legislative vehicles to attach it to. He was critical in getting the SBEA included in House Ways and Means Committee Chairman Dave Camp’s (R-MI) tax reform discussion draft in 2014. He was responsible for obtaining a “positive” score on the SBEA, which meant it could be included as a provision to pay for a tax reduction on a larger bill. He also made sure the House Ways and Means Committee had thoroughly vetted the SBEA, and that it would seamlessly be inserted into the Internal Revenue Code if it did pass. Simply put, the SBEA would not be the law of the land without the efforts of Rep. Brady.

Sen. Grassley has been championing the SBEA since 2002, and was a sponsor of legislation that ultimately became the SBEA in 1997. In 2003, he alone introduced the SBEA in the Senate. In 2005, he sponsored the SBEA with Sen. Max Baucus (D-MT). Again, in 2011 and 2013, he sponsored the SBEA and worked to find the right tax legislation to attach it to. For several years, Sen. Grassley single-handedly kept the SBEA alive in the Senate. He has championed the bill longer than any other current Member of Congress.

Sen. Nelson was critical in getting the SBEA through a democratic-controlled Senate. He worked with his colleagues on the Senate Finance Committee to ensure they were comfortable with the SBEA. He promoted the SBEA to his leadership and made certain they understood how important the PEO industry is in Florida. The SBEA made it through the Senate without incident because of the work done by Sen. Nelson.

Finally, Rep. Thompson’s support of the SBEA was critical in its ultimately being included on the Achieving a Better Life Experience (ABLE) Act. When the time came to find tax provisions to pay for the ABLE Act, Rep. Thompson’s support of the SBEA provided the bipartisan support necessary for its inclusion as a “pay-for” on that bill. Without his support, it would have been far more difficult for the SBEA to be included on any bipartisan tax legislation.